Craft Beer Closures: The Shocking Truth

In San Diego, at least, failure is only temporary

[Note added 7/24/2018: This article was getting messy with all the additions, so I created an updated version as of the end of July 2018.]

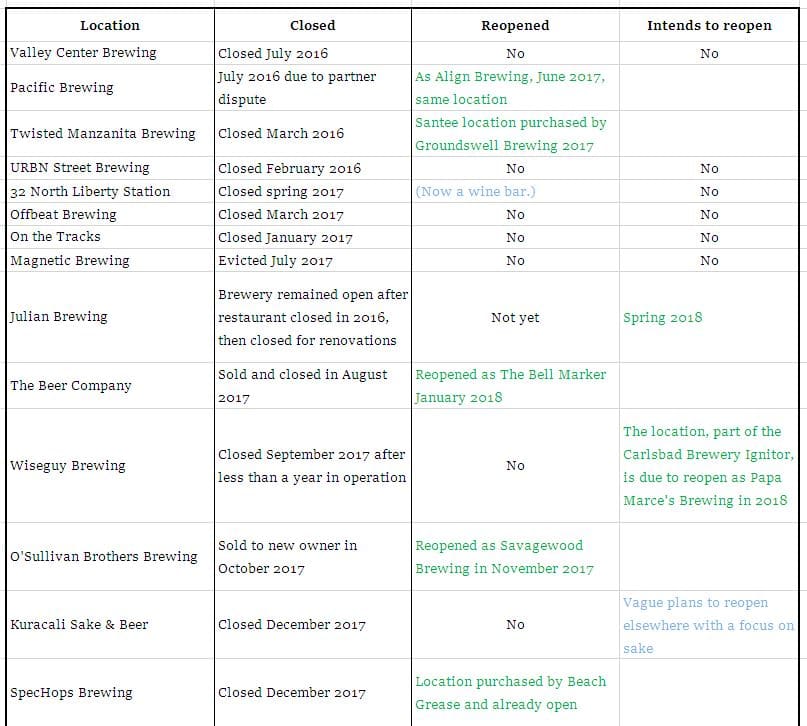

Nineteen craft beer locations have closed in San Diego county since the beginning of 2016 (2106: 4; 2017: 10; 2018: 5, with at least 2 more closing by summer). But of those closed locations, 7 have already reopened under new owners or a new name, and 3 have firm plans to reopen, and 3 have more have expressed the intention to reopen. That means that “really” there have been only 6 closures in the past 2.25 years, an average rate of a measly 2.6 closures per year.

[Note added 4/3/2018: Today’s announcement that Green Flash plus their Alpine brand have been bought out by WC IPA LLC after Green Flash’s bank foreclosed on them has sent the craft beer Twitterverse into a frenzy. Everyone is Le Freak-ing out. (Too soon?) But overall it doesn’t affect the point of this post. Counting this as a case of Green Flash failing and a new owner coming in, together with yesterday’s announcement of Fallbrook Brewing’s impending closure (and it won’t be reopened), the stats are now 7 real closures out of 21 failures since January 2016, for an annual rate of 3.1 closures per year. Keep in mind that the new owners of Green Flash would not have been interested unless they see a solid financial upside to the business in its newly-retrenched position.]

Last year saw more closures than ever before: ten locations ceased operations. But of those ten, only four are permanent closures. Three have already re-opened, two have plans to reopen in the near future, and one has a vague plan to reopen eventually. The pattern so far in 2018 is even stronger: Of five closures by the end of March–admittedly, a large number in just three months–three have already reopened, one has announced plans to reopen in a new location later this year, and another seems highly likely to open as a new brewery or additional location for an existing brewery. [Add two closures at the beginning of April, Fallbrook and Green Flash, one of which will not reopen and the other of which continues to operate under the new owners.]

So either the craft beer industry is even healthier than it seemed or we are in even more danger of a sudden crash than we thought–whichever your optimism/pessimism index leads you to feel is more likely.

![Of the 19 closures in San Diego beer since 2016 (20 including an announced closure for summer), only six have not reopened and have no plans to reopen. [4/3/18: Green Flash now under new ownership, Fallbrook closing 4/15/18. So now the total is 21 (22 by summer) closures with only seven that have not/will not reopen.]](https://beermaverick.com/wp-content/uploads/2020/08/reopeningschart2.jpg)

Of the 19 closures in San Diego beer since 2016 (20 including an announced closure for summer), only six have not reopened and have no plans to reopen. [4/3/18: Green Flash now under new ownership, Fallbrook closing 4/15/18. So now the total is 21 (22 by summer) closures with only seven that have not/will not reopen.]

The Brewers Association’s annual summary of the previous year’s data on the number of breweries and the volume of production in the USA came out recently, prompting the usual discussions about the status and health of the craft beer industry. See the write up on Brew Studs for example, or the original press release from the Brewers Association.

For the last few years the slowing of the growth of craft beer has been a story, in a Chicken Little sort of way–craft beer is still growing, after all, and is doing so despite US beer production overall being down slightly. (Which means, with the sort of schadenfreude that craft beer fans love to feel, big beer is shrinking while craft beer is growing.) To become worried because your industry is experiencing 5 percent growth by volume (8 percent by retail sales value), and has been on a growth trajectory for years, seems a bit odd to me. I suppose some day the pessimists will be right. From what I have recently discovered, however, I don’t think that will be any day soon, at least not in San Diego.

This year, the story that is catching the pessimists’ eyes is that there were a record number of closures of breweries in 2017, when 165 breweries shuttered. Though the current brewery failure rate is higher than it has been, it is still a remarkably low rate of failure compared to other small businesses. In restaurants, for example, 17 percent fail in the first year. For craft breweries, the failure rate in 2017 was just 2.6 percent. And that’s in a year when overall the number of operating breweries grew by 16 percent.

Now, these closure numbers don’t account for projects which failed to launch: I don’t mean pipe dreams that never came to fruition, I mean things like Little Miss’s OB tasting room and Benchmark’s Bay Park tasting room, which were well into construction when local governments squashed them. And add to that the ambitious but long-simmering Depot Springs project that was halted when construction was 70% completed because the developer ran out of money. Also (probably) in this category is Barrel Rescue, another brewery that has been “coming soon” for a long time, who recently announced that they are “going soon,” too: Due to their landlord selling the building they occupy, they are going to have to leave by June. They announced a plan to open in March before closing in June, and then looking for a new home in which to open. (They didn’t make their March opening goal. We’ll see if they can survive the turmoil.)

My data on the openings and closings of breweries and tasting rooms in San Diego takes no account of expansions and contractions at individual companies. Green Flash’s recent series of announcements (layoffs, contraction of distribution from 48 to 9 states, auction of Virginia brewery before it starts operating, closure of Cellar 3) is certainly bad news for the affected employees, but my suspicion is that it is a symptom of over-quick expansion attempts by a specific company rather than a harbinger of things to come in the craft beer industry as a whole. And we need to balance news of contractions with stories like those from Burning Beard and Helix Brewing, both of which have started significant on-site expansions to increase production to meet existing and future demand. Similarly, although Ballast Point will close its Scripps Ranch location later this year, all the staff and production volume will be maintained in a new facility at the main Miramar brewery.

In the last twelve months, the period over which I’ve been closely tracking things, the net increase of 19 breweries and tasting rooms in San Diego is impressive. That represents 11.9 percent growth over the 160 San Diego craft locations that were open twelve months ago. It is even more impressive when you recall that in the same period ten locations closed. Those closures mean the net increase of 19 actually came about because *29* new projects opened up in 2017. This means that 29, or 15.7 percent, of the 185 currently active locations (including non-craft breweries) opened within the last twelve months. Leaving out the six non-craft breweries, that’s 29, or 16.2 percent, of the 179 currently active San Diego craft locations that opened in just the last twelve months.

There is an impressive number of projects announced as opening later this year, too. By my count, there are 25 breweries and five tasting rooms that are highly likely to open before the end of 2018. And those are just the ones I know of.

I think it is safe to say that beer is still booming in San Diego.