More on Craft Beer Closures in San Diego

In March, I posted an analysis of the various closures that had happened recently in the craft beer industry in San Diego. It turned out to be a popular post, so this is an updated version that takes into account some additional events and information.

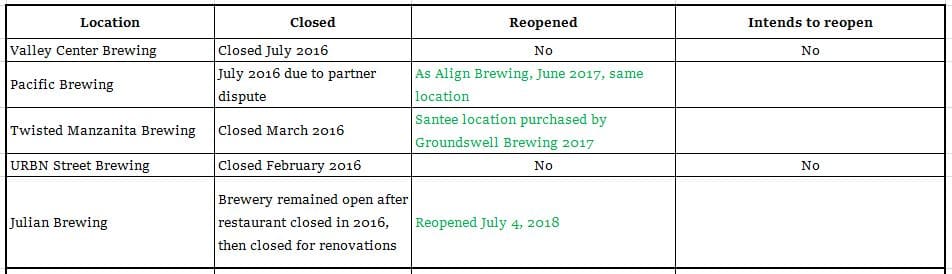

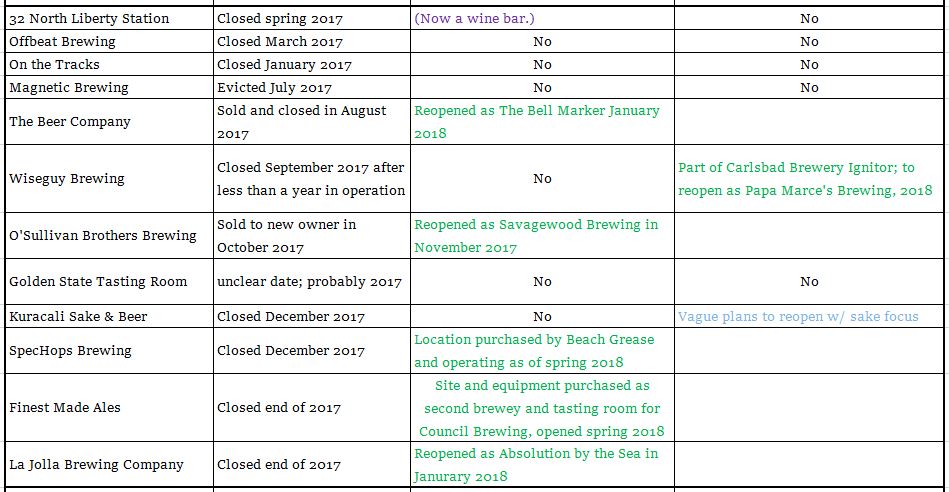

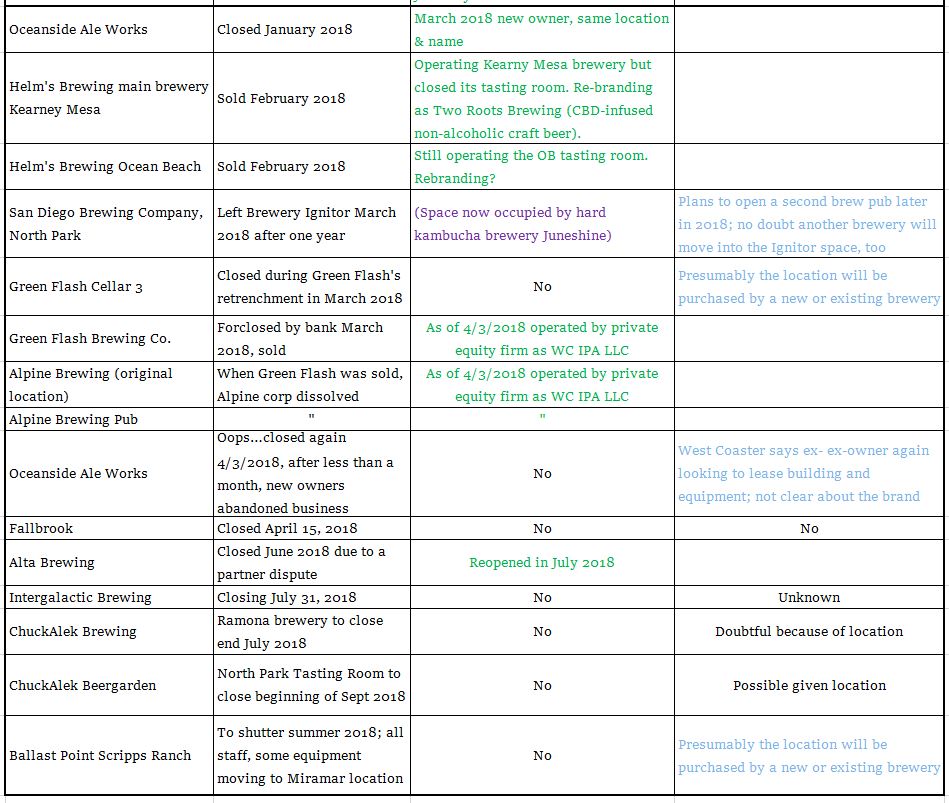

Thirty craft beer locations have closed in San Diego county between the beginning of 2016 and the end of July 2018 (2106: 5; 2017: 12; 2018: 13), with at least 2 more closing by the fall of 2018.

But of those thirty closed locations, fifteen have already reopened under new owners or a new name, 1 will re-open, and 7 seem likely to eventually reopen in some form. That means that “really” there have been only 10 “permanent” closures in the past 2.75 years, an average rate of a measly 3.6 closures per year.

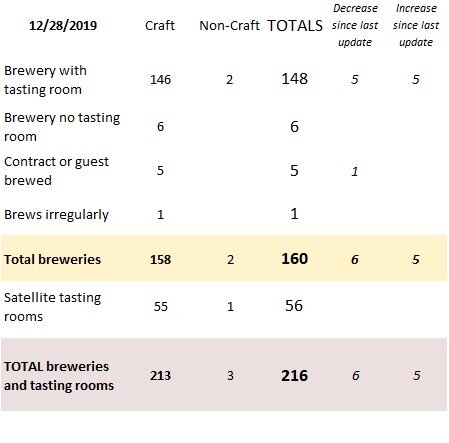

Or, if you are against counting chickens before they hatch, 16 out of 32 closures have reopened/will definitely reopen, leaving 16 “unreopened” (to coin a phrase). Even on that metric, that’s just 5.82 closings per year over the last 2.75 years. In the same period the industry has grown from about 130 locations to over 190 (23 percent growth compared to 2016).

As I pointed out in the original post in March, for comparison, 17% of restaurants fail in the first year. In 2017, the failure rate for all craft beer locations in San Diego county was just 2.7 percent (5 permanent closures from 179 locations open by the end of the year). 2018 is on track for a similar rate. Between 4 and 8 of the closures so far will be permanent in the sense used here, and there will be roughly 200 locations by the end of the year, which would be a roughly 2-4% permanent closure rate. (As of July 2018, there are 192 breweries and tasting rooms in San Diego, plus 14 non-San Diego craft brewpubs.)

Some people find it rude or distasteful to say bad things about breweries that have failIed, and I don’t mean to pour salt on any wounds. But if we look at the permanent closures, they are mostly places that made bad decisions in one way or another–about location, hours, distribution, staff/attitude, undercapitalization–or which simply didn’t produce good enough beer.

For examples, look at the eight locations in the chart that are definite permanent closures. All opinions here are my own and you might disagree, but I think I’m reflecting general beliefs when I say the following:

Valley Center Brewing was in a bad location far from population centers. URBN Street Brewing was a distraction from the pizza business they really want to be in. 32 North at the time was making weak beer and did a poor job staffing an odd location (inside a clothing store?) at Liberty Station. Offbeat, Off the Tracks and Magnetic had financial/location/beer quality problems. No one knew that the Golden State tasting room even existed. Kuracali had weak beer, a terrible location and a really strange set up. Green Flash Cellar 3 was a victim of the overall bad financial management of the corporation as it overexpanded while undercapitalized. Oceanside Aleworks made mediocre beer and had other weaknesses (including feuding partners and undercapitalization). Fallbrook was in too small a town and too far off the beaten path, and their beer was mediocre. Intergalactic was a sentimental favorite for some SD beer folks but it somehow never attracted enough business and seemed to be undercapitalized–certainly the writing had been on the wall for a long time. ChuckAlek was in a bad location and the owners decided to take jobs out of state. Ballast Point is centralizing production on its main Miramar campus just a few miles away.

So what are the lessons that can be gleaned from all this? I’m not sure there are really any big lessons. Location clearly matters, as does making quality beer and providing an excellent customer experience. And being properly capitalized seems to be absolutely crucial. But we knew all that, right?

The closures this year, though greater in number than in recent memory, remain a small percentage of the overall total. At the same time, new locations continue to open at a steady pace. There were 179 locations at the end of 2017. Today, there are 192–and that’s after subtracting the 4 permanent closures so far this year. That’s 17 new locations in eight months. Several more will be opening in the near future–including Mikkeller, Duck Foot, Melvin, and Attitude, plus more. I project three tasting rooms and nine breweries will open by the end of the year, which will bring the total to around 200 San Diego craft brewery locations. It is safe to say, I think, that craft beer is still booming in San Diego. Given the evidence, there is no reason to think the San Diego beer market is oversaturated.

A final note: Two of the projects I mentioned in my March post as having failed to launch, have in fact revived: It was just announced that Depot Springs was purchased by a major restaurant group and will become Draft Republic Brewing, and Benchmark’s Bay Park tasting room eventually opened after all in mid-July 2018.

I’ve long had an informal theory in my head about art. It takes huge masses of less-than-stellar artists, according to my theory for which I have no evidence, to create an environment in which an occasional exceptional artist can arise. Maybe something similar happens in beer, too, so that we should expect some not-great beer, and we should expect that some breweries will fail: those are the conditions required for the rise of good and great beer. In short, the sky is not falling. All is well in The Capital of Craft.

![ChuckAlek Independent Brewers, Ramona [CLOSED]](https://beermaverick.com/wp-content/uploads/2018/01/IMG_4103-768x1024.jpg)