San Diego Beer in 2018

Maybe this is true of every year but, wow, it seems like a lot has happened in craft beer this year. This is a long read (about 3400 words), but I hope you’ll find some interesting stuff here. Just so I don’t bury the lede: San Diego County saw a net increase of thirteen breweries and satellite tasting rooms in 2018, a 7.3% increase over 2017. There is a lot of detail needed to contextualize and explain that number, however.

Beer Writing in 2018

In some ways, it has seemed like an ominous year for beer writing. The venerable All About Beer Magazine shut down after thirty-nine years. Part of the reason, at least, is a decrease in the number of people who read print magazines, including print magazines about beer. Even The Session, an online venue for bloggers to participate in writing on a single topic where the posts are collected together in one place, has come to an end after almost twelve years and 142 monthly topics. A lack of interest and a change/decrease in beer blogging was cited as a reason. And, it seems, it is getting harder to make a living solely as a beer writer, with layoffs at various outlets.

At the same time, however, readbeer.com started up in fall 2018. It is a beer blog/news aggregator, and as of 12/28/2018 it has 184.5 pages of 2018 beer articles and blog posts where each page has 18 articles listed. That’s 3,321 articles about beer in 2018, and I’m sure that’s not a comprehensive list. The problem The Session had with finding hosts and getting participation might not be that beer blogging has decreased, but rather that it has exploded to the point that the beer blogosphere is fragmented and disconnected. I didn’t even know about The Session until about a week before I hosted one in October 2018, and I’ve been reading and writing about beer extensively for more than two years. Hypothesis: Craft beer writing is mostly local now, just like craft beer itself.

I published forty-eight brewery and tasting room reviews in 2018, bringing my total to 212 reviews since starting BeerMaverick.com in September 2016. In addition, this year I started doing occasional posts that were not location reviews. For example, I described my trip to the 2018 Great American Beer Festival in Denver, did a round-up on my experiences tasting all the San Diego GABF medalists from 2017, offered a “best of San Diego” list, started a series of SD neighborhood beer tours (three published so far), wrote two popular posts on San Diego brewery closures, and more.

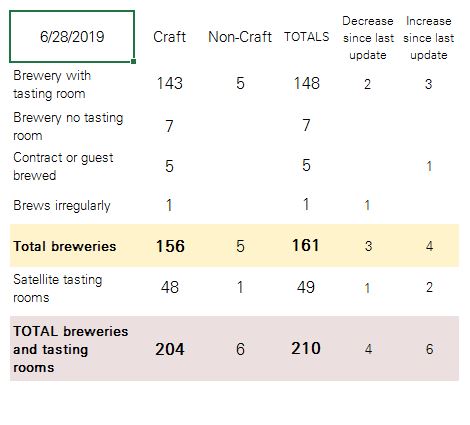

In addition, I published my monthly summary of openings and closings in the San Diego beer industry and its accompanying LIST — the best, most complete and most current list of San Diego breweries and tasting rooms available anywhere. At the end of 2018 there are 199 breweries and tasting rooms in San Diego. More on that below.

I was fortunate that my beer blogging won me a national award: BrewDog’s 2018 Beer Blogger Geek award, plus the overall award out of the seven categories in their competition, which makes me the 2018 America’s Biggest Beer Geek. Eoghan Walsh, Europe’s Biggest Beer Geek, edged me out for the title of World’s Biggest Beer Geek, but he definitely deserved it. It has admittedly been a complicated year to be associated with BrewDog given their various marketing shenanigans/screw-ups, but the judges of the contest were independent, and the competition was stiff, so I am very appreciative of the recognition. And I’m grateful for the trips to Denver and Belgium that were the prizes. The other winners I had the pleasure of meeting in Denver were all awesome people.

[In non-beer writing news — it’s my blog, I can write what I want to — I also had my first academic book accepted for publication and I submitted the final manuscript. That book will be published in April 2019. And I started my first novel. About 47,000 words drafted so far.]

The San Diego Beer Scene in 2018

The number of breweries in San Diego at the end of 2018 is almost identical to the same time last year. But that numerical consistency masks a great deal of change. Some people have claimed that there’s a slowdown in the growth of San Diego craft beer, but I don’t think that’s the right take, as I’ll explain below.

Early December 2018 saw two events that shook the SD beer community: Benchmark’s seeking of an investor, and Council’s closing. Some people have taken it as a sign of doom. The question is whether these two cases, and the other closings in 2018, are a statistical blip, a market correction, or something else.

Since the beginning of 2018, nineteen new craft breweries and eleven satellite tasting rooms have opened in San Diego (including four closings and re-openings under new owners). That’s thirty locations in fifty-two weeks or 0.58 openings per week. In 2017, it was twenty-eight new breweries and seven new tasting rooms for a total of thirty-five new locations, or 0.67 per week. That’s a pretty small difference, year-over-year.

There is a sense in which brewery openings are a “lagging indicator” of the health of the industry: People make plans to open a brewery or tasting room usually much more than a year before it happens, and they make those plans based on then-current market conditions (often optimistically interpreting those market conditions). So it is possible that a bunch of breweries just opened into a bad market. Costs are certainly rising, thanks in part to increasing rents, corresponding pressure to increase wages, and increases in supply and equipment costs (partly due to Trump’s tariffs). There is also increasing competition for hops and other ingredients because of the increasing number of breweries around the country and around the world.

The closing of Council, a highly respected and well-loved brewery that seemed (from the outside, at least) to be on an upswing, was a shock to many in the San Diego beer loving community. The announcement didn’t give all the details and others may know a lot more about this that I do (please add your knowledge in the comments below), but it sounds like opening the Santee brewery and tasting room was a kind of last-ditch, Hail-Mary move for them. They had already been struggling and decided to “go big or go home” in a sense, throwing everything at an expansion in the hopes that it would pay off big, and quickly enough. That didn’t happen, and without sufficient reserves and without reasonable expectation for sufficient growth to cover their increased costs, they decided to pull the plug. They were paying rent (and staff) for three locations (Kearny Mesa brewery and tasting room, a nearby warehouse space for aging beer, plus the brewery and tasting room in Santee). It is worth mentioning that the Santee location they purchased seems to be cursed: Twisted Manzanita had the space awhile and shut down, Finest Made Ales (originally named Butcher’s Brewing) had it awhile and shut down, and now Council. In a grand gesture, Council sold down their stock of bottles for $5 cash, each, and donated the proceeds to the Sore Eye Sudsmas food drive: they gave a check for over $14k, which is extremely generous in any circumstance but especially so in the context of shutting down their business.

Benchmark’s woes are partly attributable to shifting beer trends — they make excellent but non-hype beers, and a lot of attention/market activity is related to hazies, pastry stouts, and other adjunct-laden beer. I think the long delay in being able to get their Bay Park tasting room open is a factor — they had to pay rent there for months without the location generating an income stream. I think they also suffer from location problems. The brewery location in Grantville is not one that people think of visiting (even though the tasting room is very nice) and it isn’t close to enough other high-traffic breweries to benefit from a synergy like we see in the Miralani Makers District, for example, where people visiting one location very often visit other adjacent locations. I’m as yet unconvinced that the Bay Park location they chose has enough traffic (or parking) to make that location as viable as their beer would justify. Benchmark also suffered from what they described as a bad distributor relationship and thus their outside sales were declining. Now that they have switched distributors and have stopped the bleeding, I think they have a very good chance of making it. Help them out: Go drink their beer. [Edit: It didn’t work. Benchmark Brewing closed down permanently in June 2019.]

The situation with Green Flash earlier this year, and especially its sub-brand Alpine, was shocking for many fans, too. That was pretty clearly a case of bad business practices, though: over-expansion and undercapitalization with way-too-optimistic sales projections. The down-sizing and realignment after being purchased by a venture capital firm seem to have allowed things to settle. One presumes that the venture capital firm would not have been interested in purchasing the brewery if it didn’t see a financial upside. You may have noticed the re-branding that is underway, including the re-launch of the original-recipe West Coast IPA.

So, the big question: Do all these closures indicate that the San Diego craft beer market is oversaturated, finally? Is the recent spate of meaningful closings a market correction, a general economic downturn, or just a statistical blip? I’m not an economist, so I can’t give a definitive opinion on all of that, but my impression is that things are not dire — far from it, in fact. New breweries are opening at a rate similar to previous years. There is overall growth, and even more new breweries and tasting rooms are slated to open in the near future. There were more closures this year than we are used to, for sure, but the numbers don’t raise any real cause for concern. There is a false appearance of more closings simply because there are so many more breweries, but the rate of real closings is not much more than last year, and it is much less than the average closure rate for bars and restaurants.

Don’t forget, too, that in addition to nineteen new breweries and eleven new tasting rooms, several (many) local breweries are flourishing and even expanding. Look at Helix’s new Sourworx barrel aging program, or Second Chance’s. Burning Beard just started a coolship natural fermentation and barrel aging program. Modern Times, Novo Brazil and others have significantly increased production and distribution. Protector is vastly expanding its capacity. Plenty of others are aiming to expand production and sales, too. There will be winners and losers as breweries jockey for shelf and tap space, of course, so we’ll see which of these moves pay off.

There is definitely increased competition. That is going to force breweries to be firing on all cylinders in order to be successful. The days of easy, quick growth, especially in wide distribution, are pretty clearly over. But smaller, locally-focused (neighborhood-focused) breweries have opportunities to thrive, provided they do everything well. New breweries probably have a shorter window of time during which consumers will cut them slack while they dial in recipes. There are so many excellent options in town that few are willing to drink mediocre craft beer anymore.

Most of the breweries in planning that I am aware of share a feature that should make some existing breweries worry: many of the newcomers have strong financial backing and are entering the market with large, high-concept places that include food and are elegantly designed. Kairoa, Gravity Heights, Double Peak, Draft Republic, Original 40, and My Yard Live all fit this description.

There’s a potential worry that’s on few people’s radar, though Mike Shess from West Coaster Magazine and San Diego Beverage Times is thinking about it: There are now a lot of wineries and wine tasting rooms in San Diego. And cideries and meaderies. And distilleries. That’s competition for folks’ limited entertainment dollars that could have an impact on the local brewing scene.

Should breweries chase the trends? My opinion — or maybe it is a hope — is that they shouldn’t. If hazies or pastry stouts are why you exist, great, though watch out when trends change. But if your market identity is something else, making such beers only to be part of the trend will probably not be successful, in my opinion at least. You might get a temporary bump, but long-term consistent business depends on excellence. Excellence can only come from being yourself. There’s an important sense in which chasing trends is a kind of selling out; maybe as bad or worse than selling out to Big Beer. I understand the need to do what is required to stay in business, but there is a wide and deeply interested consumer base who will drink good beer when they can get it, and those are the folks who will bring you long term success. There might not be enough of such people to support ten places like Deft, but there is clearly room in the market for one; same for Benchmark.

Consumers need to take some responsibility, too. If you are spending your beer money trading online or even chasing whales at the bottle shop, that money is mostly not going to support local breweries. Ask yourself whether the $100 bottle you bought is really worth ten $10 bottles of a different beer, or even twenty $5 bottles. You’ll never convince me that the $40 pint-bottle of pastry stout on the shelf at Whole Foods is really six times better per ounce than the Speedway Stout or fifteen times better than the Tabula Rasa on the shelf next to it. Imagine if all the money that went into chasing whales went to breweries instead of to brokers and illegal traders. In short, if you care about craft beer, buy local craft beer. I’m not saying you should buy bad beer: I’m saying you should spend your money in a way that supports the industry you claim to love.

Craft Beer Nationally in 2018

Nationwide, sales by volume are up 5% over 2017 to reach a new record high once again. And that’s despite a 1.2% drop overall in beer sales by volume. There are now 7000 independent breweries in the USA, up 20% (!) over 2017. Eighty-five percent of the US population lives within ten miles of a brewery.

In 2016, there were 2042 brewpubs, 3196 microbreweries, and 186 regional breweries across the US.

In 2017, those numbers were 2252, 3812, and 202. In other words, in 2017 there was an increase of 210 brewpubs, 616 microbreweries and 16 regional breweries. That translates to growth of 15.5% by brewery count, as compared to the end of the previous year.

In 2018, there appears to be roughly 12% growth in the number of breweries, to a new record high of 7000 breweries, but the details are not available yet. Sales by volume increased overall by 5%, so there are growers and shrinkers among the 7000.

Craft beer slightly increased its share of total national beer sales by volume to 12.7%. Although it is an increase, that should be a sobering number, I think, especially for those of us whose focus is entirely on local independent beer: Craft beer drinkers are a tiny minority of all beer drinkers. There is less craft beer purchased in the USA than import beer, even. However, this does indicate that there is still plenty of growth opportunity for craft beer, since the vast majority of US beer drinkers are not (yet!) drinking craft beer.

In 2017, nationally 165 brewpubs and microbreweries closed, while 995 opened. As rates measured against the total operating locations at the end of 2016 (5238), that means a 3.15% closure rate and a 19% opening rate, nationally. Comparable data is not available yet for 2018.

Craft Beer in San Diego in 2018 by the Numbers

In San Diego in 2017, we saw net growth of nineteen locations or 12% compared to 2016. Ten craft breweries and tasting rooms closed and twenty-nine opened in 2017.

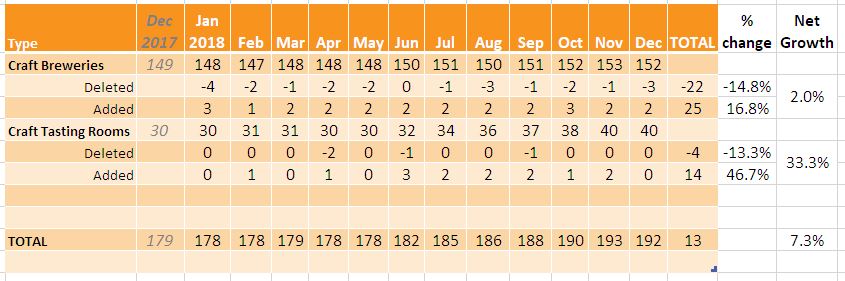

In 2018, things look different in San Diego. We have slow growth in the *net* number of breweries. In December 2017, there were 149 craft and six non-craft breweries in San Diego; in December 2018, there are 152 craft and five non-craft breweries. That represents 2.0% growth in the number of San Diego craft breweries over 2017.

Like a duck looking still on the surface but paddling furiously underwater, however, the net 2% growth in number of breweries masks a lot of activity underneath. Between my December 21, 2017, update and December 30, 2018, twenty-two breweries closed, and twenty-five craft breweries opened. That corresponds to closing and opening rates of 14.8% and 16.8%, respectively. Note, however, that that this calculation includes six breweries that continued existing after being purchased by new owners as both a closing (sale) and an opening (purchase). If you consider just the breweries that closed outright or opened from nothing, then sixteen breweries closed, and nineteen brand new breweries opened for respective rates of 10.7% and 12.8%.

At the same time, however, there was massive growth in the number of satellite tasting rooms in 2018. There are forty-two satellite tasting rooms in the county now (including two non-craft), whereas there were only thirty satellite tasting rooms (including zero non-craft) at this time last year. That increase of twelve is FORTY PERCENT GROWTH in the number of satellite tasting rooms in 2018. For craft satellite tasting rooms alone, the growth was ten locations or 33%.

In total, the net change in 2018 is an increase of thirteen craft beer locations in San Diego County. We are up to 192 breweries and craft tasting rooms, which is a 7.3% increase over the 179 we had at the end of 2017. In addition, there are seven non-craft locations, one more than last year.

It is important to note that an element of chance is skewing the 2018 numbers, too. According to information I’ve gathered, before the end of January 2019, three new breweries and three new tasting rooms will open. Most of those (plus several others on my “in planning” list) had originally thought they would open before the end of 2018 but hold ups with permitting, construction, etc., have delayed them. Without those delays, the 2018 numbers would look a lot more positive.

Plus, the end of 2017 and dawn of 2018 saw several sudden brewery closures. We’ll see if that phenomenon becomes a trend, but I hope not.

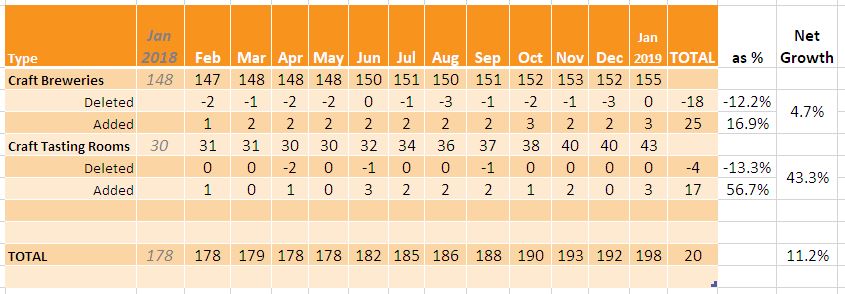

So, if this year-in-review post had been written in January, the picture would seem a lot different. Assuming everything projected to open by January 2019 really does open (and for once there is every reason to believe that will actually happen), there will be 155 craft breweries and forty-three tasting rooms.

-

The net growth January-to-January would be seven breweries or a respectable 4.7% growth over the 148 operating at the beginning of 2018.

-

Removing the six breweries that were closed then reopened under new owners, January 2017 to January 2018 will have twelve closures and nineteen openings.

-

Craft satellite tasting rooms will have increased in that period by thirteen, or 43%.

-

Taking craft breweries plus satellite tasting rooms together, there will be a January-to-January increase of 20 locations, or 11.2% growth overall.

It is useful to remember the arbitrariness of annual comparisons. There is no significance to growth being measured December-December instead of July-July or April-April.

The December 2017 to December 2018 change in craft breweries and craft satellite tasting rooms in San Diego County.

The January 2018 to January 2019 change in craft breweries and craft satellite tasting rooms in San Diego County.

Here is a topic I want to address in a future piece: How do administrative barriers impact breweries? My guess so far is that local, state and federal regulations are a severe brake on brewery and tasting room growth, both as barriers to entry and as sources of significant delay and expense. The only “winners” because of this are landlords who get paid rent while businesses sit empty waiting for approvals. Sometimes they open eventually (Benchmark Bay Park) and sometimes they don’t (Little Miss OB).

Below are some of the sources used for this post, in case you want to dive into the details.

https://www.brewersassociation.org/press-releases/brewers-association-celebrates-the-year-in-beer/

https://www.brewersassociation.org/statistics/number-of-breweries/

https://www.brewersassociation.org/insights/brewery-growth-both-urban-and-rural/

https://www.brewersassociation.org/statistics/national-beer-sales-production-data/

https://www.beervanablog.com/beervana/2018/12/11/no-country-for-old-breweries

https://www.sandiegouniontribune.com/entertainment/beer/sd-et-beer-bubbling-up-20181113-story.html

https://www.sandiegouniontribune.com/entertainment/beer/sd-et-peak-beer-closures-20181210-story.html

http://sdcitybeat.com/food-drink/final-draught/a-year-in-san-diego-beer/

https://westcoastersd.com/2018/12/27/2018-recap-best-beers-of-the-year/

https://westcoastersd.com/2018/12/26/2018-recap-best-new-breweries-of-the-year/